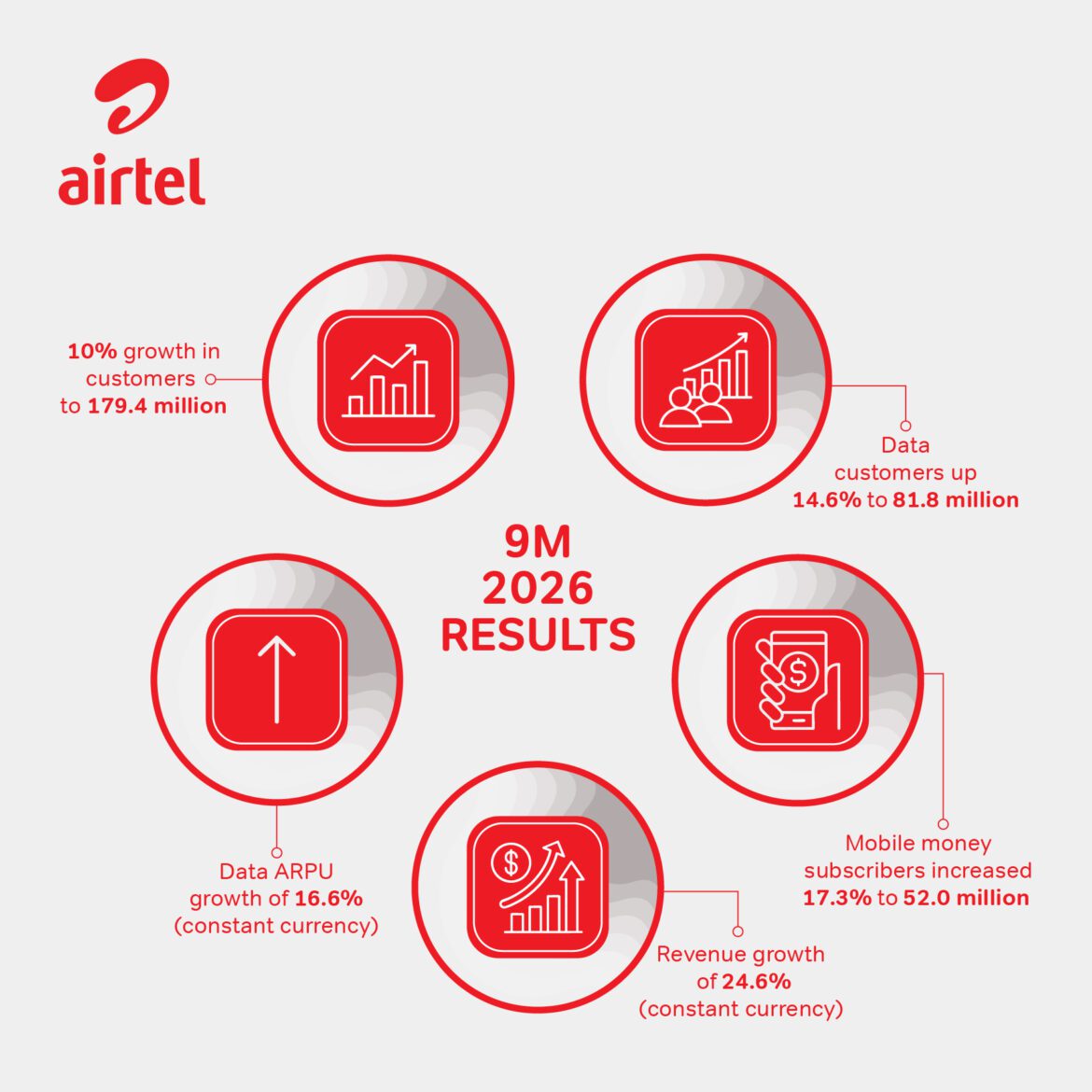

Continuing to demonstrate the business’s growth potential, delivering another strong quarterly performance

Operating highlights

- The customer-centric strategy continues to underpin strong operating momentum, with increased network investment, digitization and innovative new partnerships, demonstrating tangible progress in delivering our strategic priorities. The total customer base increased by 10% to 179.4 million, with data customers of 81.8 million, growing 14.6%. Smartphone penetration rose another 3.9% to 48.1%, with data ARPU’s growing by 16.6% in constant currency as data usage per customer increased to 8.6GB per month from 6.9GB in prior period, facilitated by the enhanced network investment.

- Airtel Money continues to scale, with two major milestones reached this quarter. The first milestone saw the business exceed 50 million subscribers, reaching 52.0 million customers up 17.3%. Secondly, annualized total processed value (TPV) for Q3’26 surpassed the $200bn threshold, with an increase of 36% to over $210bn. A broader ecosystem and stronger digital adoption contributed to a 9.8% increase in constant currency ARPU.

Financial performance

- Revenues of $4,667m increased by 24.6% in constant currency and 28.3% in reported currency as currency appreciation supported the strong underlying fundamentals of the business. The strong execution of our strategy delivered constant currency revenue growth acceleration to 24.7% in Q3’26, which was further supported by currency appreciation resulting in32.9% reported currency revenue growth.

- Mobile services revenue grew by 23.3% in constant currency. Data revenues, the largest contributor to group revenues, increased 36.5% with voice revenuesgrowingby13.5%. Mobile money revenues continue to benefit from the strong operating momentum to deliver 29.4% growth in constant currency.

- EBITDA grew by 35.9% in reported currency to $2,283m with EBITDA margins expanding further to 48.9% from 46.2% in the prior period. Q3’26 saw a further sequential increase in EBITDA margins to 49.6%, driving EBITDA growth of 31.0% in constant currency and 40.8% in reported currency. The margin performance has been driven by the strong revenue growth and sustained benefits from our cost efficiency programme.

- Profit after tax of $586mimproved from $248m in the prior period. Higher profit after tax in the current period was driven by higher operating profit and derivative and foreign exchange gains of $99m, as compared to $153m derivative and foreign exchange losses in the prior period.

- Basic EPS of 13.1cents compares to 4.4 cents in the prior period, predominantly reflecting the growth in operating profit and derivative and foreign exchange gains in the current period compared to losses in the prior period. EPS before exceptional items increased from 6.2 cents in the prior period to 13.1cents, largely reflecting the increased operating profits and derivative and foreign exchange gains in the current period.

Capital allocation

- Given the significant opportunity across the markets, Airtel has accelerated the investment in-line with our revised capex guidance as previously communicated. Capex of $603m increased by 32.2% over the prior period as we rolled out approx.2,500 new sites and expanded our fibre network by approx. 4,000kms to 81,500+ km to enhance both coverage and capacity, supporting a strong customer experience.Overall population coverage has reached 81.7% – an increase of 0.6% from a year ago.

- Leverage has improved from 2.4x to 1.9x, with lease-adjusted leverage also improving to 0.7x from 1.1x a year ago, primarily driven by the improvement in EBITDA.

Sunil Taldar, chief executive officer, on the trading update:

“These results highlight the strength of our strategy, with strong operating and financial trends across the business. During the quarter, we accelerated investment to enhance coverage and data capacity while also expanding our fibre network. Coupling this investment with innovative partnerships ,strengthens our customer proposition and positions us to capture the considerable growth opportunity across our markets. Digitisation, technology innovation and embedding AI in our processes will also optimise the customer experience with increased digital offerings and closer integration of GSM and Airtel Money services allowing us to unlock the strong demand across our markets. Smartphone adoption continues to increase with penetration of 48.1%, and we are seeing solid progress inthe development of our home broadband business, reflecting the need for reliable, high-speed connectivity across our markets.

Our push to enhance financial inclusion across the continent continues to gain momentum with our Mobile Money customer base expanding to 52 million, surpassing the 50 million milestone. Annualized total processed value of over $210bn in Q3’26 underscores the depth of our merchants, agents and partner ecosystem, and remains a key player in driving improved access to financial services across Africa. We remain on track for the listing of Airtel Money in the first half of 2026.”

Disciplined execution on cost efficiency, alongside accelerating revenue growth has enabled another sequential improvement in our quarterly EBITDA margin to 49.6%, – underpinning constant currency EBITDA growth of 31% – and we remain focussed on driving further incremental margin improvements. Our strategic priorities remain clear: to keep investing in best‑in‑class connectivity, accelerate financial inclusion through our mobile money platform anddeliver agreatcustomer experience. These results reinforceour confidence in the long‑term potential of our markets and our ability to create value for all our stakeholders.”

| GAAP measures (Nine-month period ended) |

|||

| Description | Dec-25 | Dec-24 | Reported currency |

| $m | $m | change | |

| Revenue | 4,667 | 3,638 | 28.3% |

| Operating profit | 1,526 | 1,081 | 41.3% |

| Profit after tax | 586 | 248 | 136.6% |

| Basic EPS ($ cents) | 13.1 | 4.4 | 198.2% |

| Net cash generated from operating activities | 2,306 | 1,623 | 42.1% |

| Alternative performance measures (APM)[3] (Nine-month period ended) |

||||

| Description | Dec-25 | Dec-24 | Reported currency |

Constant currency |

| $m | $m | change | change | |

| Revenue | 4,667 | 3,638 | 28.3% | 24.6% |

| EBITDA | 2,283 | 1,681 | 35.9% | 31.4% |

| EBITDA margin | 48.9% | 46.2% | 272 bps | 250 bps |

| EPS before exceptional items ($ cents) | 13.1 | 6.2 | 112.9% | |

| Operating free cash flow | 1,680 | 1,225 | 37.2% | |

About Airtel Africa

Airtel Africa is a leading provider of telecommunications and mobile money services, with operations in 14 countries in sub-Saharan Africa. Airtel Africa provides an integrated offer to its subscribers, including mobile voice and data services as well as mobile money services both nationally and internationally.

The company’s strategy is focused on providing a great customer experience across the entire footprint, enabling our corporate purpose of transforming lives across Africa.

Unless otherwise stated, all growth rates represent YoY growth for the nine-month period ending 31 December 2025

- An explanation of constant currency growth is provided on page 21

- The term ‘transaction value’ has been redefined as ‘total processed value’.There is no change to the underlying definition or method of calculation.

The reported currency growth rates incorporate currency movements during the respective period, which are not necessarily indicative of future growth rates. For currency sensitivity refer to page 17.

[3]Alternative performance measures (APM) are described on page 19.